There’s a reason so many independent pharmacies have had to close in recent years: pharmacy benefit managers.

That’s according to the Federal Trade Commission, which in a harsh report released earlier this month said these companies act as “powerful middlemen inflating drug costs and squeezing main street pharmacies.”

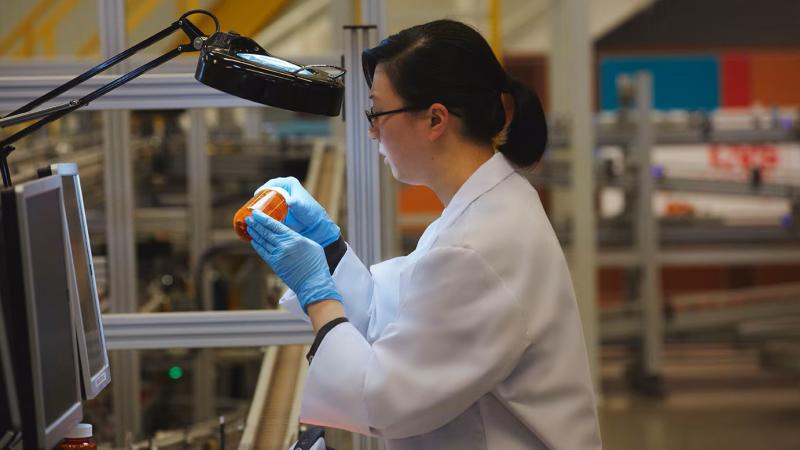

Pharmacy benefit managers, or PBMs, act as intermediaries between drug manufacturers and insurance companies to supposedly lower consumers’ prescription drug costs. Instead, the FTC found, they squeeze independent pharmacies’ profits through unfavorable contracts and paltry reimbursement rates.

This often makes filling a prescription at an independent pharmacy a more cumbersome and expensive process for the pharmacy and customer, leading to delays in care. Increasingly, it has also forced independent pharmacies to shut their doors.

The FTC report notes that PBMs “exert substantial influence over independent pharmacies, who struggle to navigate contractual terms imposed by PBMs that they find confusing, unfair, arbitrary and harmful to their businesses.”

According to the FTC report, a tenth of independent pharmacies across the country closed between 2013 and 2022.

The damage has been even starker in Maine: a third of the state’s independent pharmacies closed between 2013 and 2023, a Maine Monitor analysis found.

Overall, a tenth of the state’s pharmacies — chains and independents — closed over the past decade, leaving big gaps in access to care, particularly in Maine’s most rural areas.

“Closures of local pharmacies affect not only small business owners and their employees, but also their patients,” the FTC report says. “In some rural and medically underserved areas, local community pharmacies are the main health care option for Americans, who depend on them to get a flu shot, an EpiPen or other lifesaving medicines.”

Pharmacist Steve Maki opened Spruce Mountain Pharmacy in the Franklin County town of Jay 15 years ago. In the last five years, he said, PBMs have “become more and more invasive in the practice of pharmacy.”

“The PBMs’ role has always been to act on behalf of the insurance company to set up plans and programs that allow patients to get their medications, but at the same time work in the best interest of the insurance company (and) making sure that their (own) business is profitable,” Maki said. “And unfortunately that’s come at the cost of access to patients.”

Increasing consolidation

Health insurance, public or private, falls into two coverage areas: Medical coverage (doctor and hospital visits) and prescription drug coverage. While insurance companies handle the medical side, they contract with PBMs to oversee their prescription drug programs.

PBMs negotiate the price of drugs with manufacturers and secure rebates from the manufacturers, pocketing a percentage for themselves and passing on the rest to the insurance companies. They also determine how much insurance holders have to pay and how much pharmacies will be reimbursed.

PBMs have been around for nearly 70 years, but their scope has evolved. In recent decades, and particularly over the past five years, health insurance companies and PBMs have seen significant consolidation, a New York Times investigation found. Today, the largest health insurance companies and PBMs are owned by the same health care conglomerates.

Take the three largest PBMs: Caremark Rx, Express Scripts and OptumRx. Caremark Rx is a subsidiary of CVS Health Corporation, Express Scripts is a subsidiary of Cigna, and OptumRx is a subsidiary of UnitedHealth. Some of these conglomerates also own their own retail pharmacy chains, mail-order pharmacies and specialty pharmacies.

CVS Health Corporation, for instance, acquired the insurance company Aetna in 2018, and also owns CVS Pharmacy and CVS Speciality, its brick-and-mortar and specialty pharmacies, respectively. On top of this, the conglomerate owns CVS MinuteClinic, medical providers located within CVS Pharmacy stores where a patient can receive urgent care and vaccinations.

That gives CVS Health a huge degree of power over an individual’s health care: from insurance coverage to care services to prescription drugs. As part of this arrangement, Aetna will often give customers preferential drug pricing or only cover prescriptions filled at CVS pharmacies, or push customers to use CVS Caremark’s mail-order pharmacy service.

Likewise, Express Scripts and OptumRx operate their own mail-order pharmacy services.

Together, these three PBMs manage nearly 80 percent of all prescriptions filled in the U.S.

The system leaves independent pharmacies without access to drug discounts available to the big chains and with worse reimbursement rates, said Emily Dornblaser, an associate professor at the University of New England School of Pharmacy, in an interview with The Monitor last fall.

“That has really been one of the reasons that independent pharmacies have been gutted, because they cannot actively compete with such large, organized health care system entities that span insurance to distribution,” she said.

Another highly critical report released this month accused PBMs of “anticompetitive practices,” such as low reimbursement rates and retroactive fees, that “make it difficult for unaffiliated chain and independent community pharmacies to survive.”

The report from the Republican-controlled House Committee on Oversight and Accountability said the PBMs “use their position as middlemen” and top-to-bottom integration to “protect their bottom line.”

In response to questions from The Monitor, a spokesperson for CVS Caremark, Phillip Blando, said independent pharmacies are “vital partners” and represent more than 40 percent of its in-network pharmacies across the country.

Blando said the PBM reimburses independent pharmacies “in aggregate, significantly more than CVS Pharmacy,” and disagreed with The Monitor’s analysis of independent pharmacy closures in Maine.

A spokesperson from Express Scripts said the company is “committed to supporting the important role that independent pharmacies play in rural communities” and recently launched an initiative to increase reimbursements to those pharmacies.

An OptumRx representative did not respond to a request for comment.

A state law that went into effect in January 2020 banned so-called “gag clauses” PBMs put in contracts with pharmacies that prohibited a pharmacist from informing a customer of cheaper generic alternatives or the option to pay out-of-pocket. It also said insurance carriers and PBMs must “provide a reasonably adequate retail pharmacy network” for customers that does not include their own mail-order pharmacy services, among other regulations.

The law mandated that PBMs have to obtain a license to operate in Maine, but also put insurance companies in charge of monitoring compliance.

It’s unclear if and how the law is being followed: No disciplinary action has ever been taken against a PBM, according to the Bureau of Insurance.

‘You couldn’t make ends meet’

Lee Ohmart, a retired Brewer pharmacist, worked at several chain and independent pharmacies during his 42-year career.

When he started practicing at his father’s Bangor-area pharmacy in the late 1970s, PBMs operated nothing like they do now, Ohmart said. Dealing with insurance was “almost unheard of.”

Earlier in his career, Ohmart said insurance companies paid a “reasonable amount of money” in reimbursements to pharmacies. It didn’t equal what a pharmacist made if a patient paid out-of-pocket, but “at least it was a livable amount of money.”

“But then slowly, they started reducing the amount that they would pay for,” he said. “You couldn’t make ends meet, which is why so many independents went out of business. Because, unlike chains, they couldn’t absorb those losses. And unlike the chains, they couldn’t approach the insurance companies and negotiate.”

The FTC report notes that “independent pharmacies generally lack the leverage to negotiate terms and rates when enrolling in PBMs’ pharmacy networks, and subsequently may face effectively unilateral changes in contract terms without meaningful choice and alternatives.”

Maki said some PBMs allow independent pharmacies to negotiate reimbursement rates through collective bargaining groups called pharmacy services administrative organizations.

Often, cooperatives of independent pharmacies will together contract with one of those groups to negotiate on their behalf. Spruce Mountain, for instance, is a member of the Good Pharmacy network, which contracts with a pharmacy services administrative organization to deal with PBMs for their member pharmacies.

But some PBMs, like Express Scripts, will only deal with certain pharmacy services administrative organizations. That means pharmacists who do not work with those groups, in addition to running the day-to-day operations of a drug store, must review contracts, make financial calculations and attempt to negotiate with PBMs on their own.

Several independent pharmacy owners reached by The Monitor declined to speak on the record for fear of retribution.

One owner and pharmacist, who agreed to speak on the condition of anonymity, said a PBM, in retaliation, could remove a pharmacy from an insurance network without notice. With such a high level of consolidation among PBMs, a move like that could put a pharmacy in financial peril.

The pharmacist, who runs the only pharmacy within a 25-mile radius in a rural area, also said the PBMs tell them that their contracts contain “proprietary information” that prohibits the pharmacists from speaking with each other. The effect is that a pharmacist can’t compare reimbursement rates with another pharmacist, for example, to figure out if they have fair contracts.

The FTC report notes PBMs’ business practices are “extraordinarily opaque.”

“PBMs oversee critical decisions about access to and affordability of medications without transparency or accountability to the public,” the report states.

Meanwhile, the House Oversight Committee report said its investigation found evidence that PBMs share patient information with other subsidiaries under the same corporate umbrella “for the specific and anticompetitive purpose of steering patients to pharmacies a PBM owns.”